Published on – March 30th, 2023 – Air France – Fleet

Air France is continuing to renew its fleet by inte new generation aircraft, which are more economical and environmentally friendly.

By 2030, these aircraft will account for 70% of the Air France fleet – compared with 7% at present – thanks to an ambitious investment plan of one billion euros per year.

The airline reached a symbolic milestone today by welcoming its 20th Airbus A220-300, the latest flagship of its medium-haul fleet.

The aircraft, registration F-HZUU, rolled off the Airbus assembly line in Mirabel, Quebec, and is on its way to Paris-Charles de Gaulle, where it will operate on the airline’s short- and medium-haul network.

It will make its first commercial flight on 1 April to Geneva (Switzerland).

The aircraft’s front fuselage bears the name “Grasse”, paying tribute to the pretty town in the Alpes-Maritimes region, famous all over the world for its perfume industry.

Since 2019, Air France has revived its tradition of naming its aircraft after French cities. This tradition celebrates the rich cultural and historical heritage of France’s regions, and promotes their reputation throughout the world.

Before Grasse, Air France named its previous Airbus A220s after Le Bourget, Collioure, Belle-Ile en Mer, Senlis and Arcachon.

By the end of 2025, 60 A220-300s will join the Air France medium-haul fleet. With up to 15 deliveries expected each year, this is the fastest fleet entry in the history of Air France.

Unparalleled economic and environmental performance

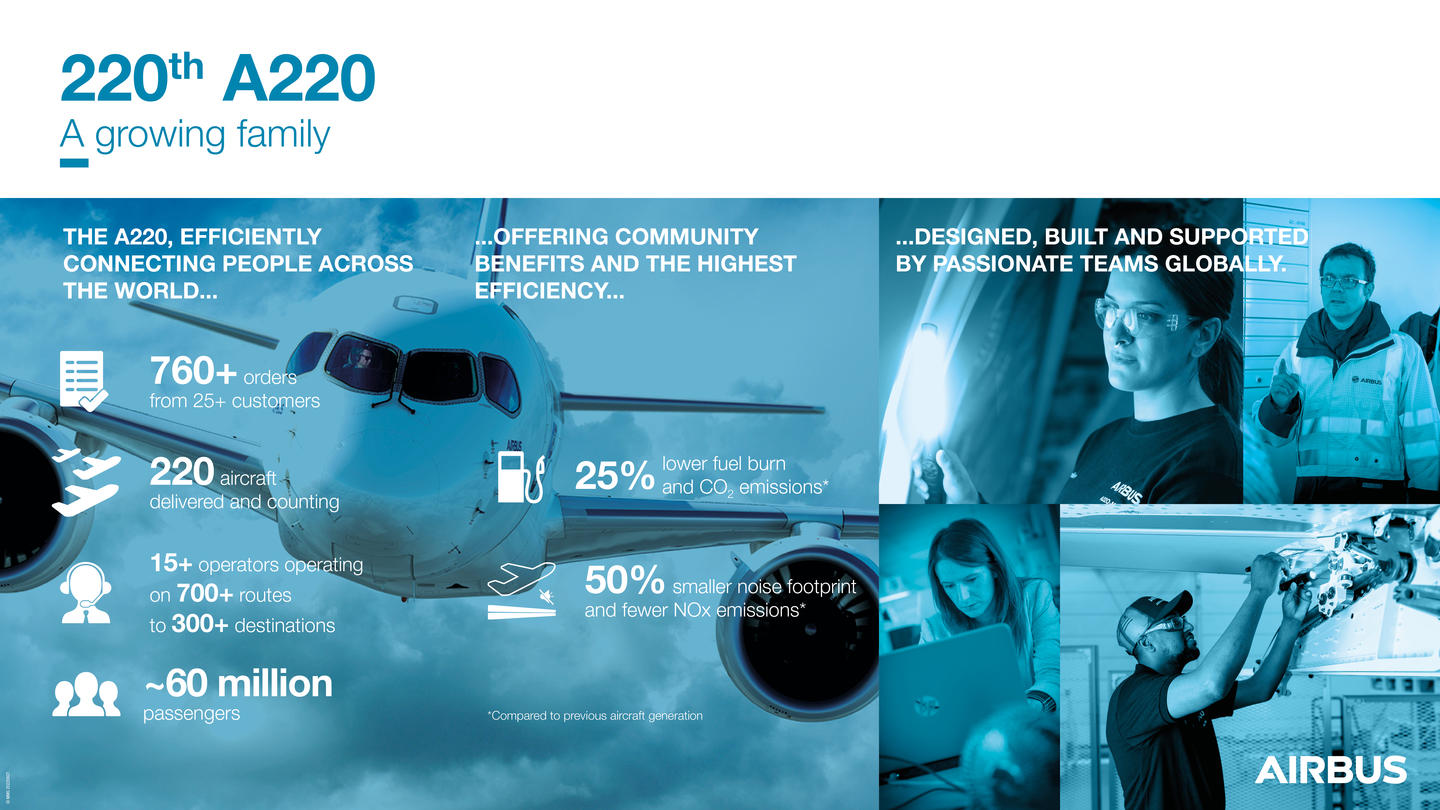

The most innovative and efficient single-aisle aircraft in its class, the Airbus A220-300 is perfectly suited to Air France’s short and medium-haul network. It provides a cost reduction per seat of up to 10% compared to the Airbus A318 and A319 and stands out for its energy efficiency, consuming 20% less fuel than the aircraft it replaces and its CO2 emissions are also reduced by 20%. Its noise footprint is also 34% lower.

Fleet renewal is one of the major levers of Air France’s decarbonisation trajectory, known as Air France ACT. Air France aims to reduce its CO2 emissions per passenger-kilometre by 30% by 2030, compared with 2019, excluding any offsetting measures. To reach these targets, Air France is doing all it can in terms of fleet renewal, the use of sustainable aviation fuel, eco-piloting and intermodality.

The highest level of in-flight comfort

The Air France Airbus A220-300 has 148 seats, in a 2-3 seat configuration (5 seats across) offering 80% of customers a window or aisle seat. The seat is the widest on the market for a single-aisle aircraft. It reclines and has an adjustable headrest, leather upholstery and an ergonomic seat cushion for enhanced comfort. A wide solid tray table, cup holder, a seat pocket, individual USB A and C ports and tablet or smartphone holder integrated into the backrest complete the package.

The cabin, the most spacious and brightest in its category, is decorated in the Air France signature colours – shades of blue, a strong presence of white providing light and contrast, and a hint of red symbolize the airline’s excellence and know-how. The central aisle is particularly wide, allowing customers to move about at ease. The carpet revisits the traditional ornamental herringbone pattern, symbolizing the emblematic Haussmann-inspired world of Parisian apartments. Large panoramic windows provide natural light for the duration of the trip. Finally, the spacious baggage racks are easy to access.

You must be logged in to post a comment.